Futarchy considered retarded

The 21st-century American university is a pathologist’s dream. But surely among its most revolting terminal diseases is a near-complete absence of any genuine intellectual hostility.

The T-cells are depleted. The bone marrow is exhausted. The mind’s immune system is almost done. Exotic cancers and weird infections sprout like desert flowers. Gray berries hang from the liver; Spanish moss burgeons in the lungs. And people believe anything. Fortunately, UR is on the case again—with our special, home-cooked chemo recipe, half LSD and half mustard gas. If it doesn’t cure you, you’ll wish it had.

If we look at what academia is, rather than what it purports to be or what it once was, the cause of this immune degeneration is obvious. Academia is a guild of talented and ambitious professionals who, by demonstrating their large and dextrous brains—not to mention their impeccable networking skills, and their infinite patience with the brown product of the cow—extract money, power, and/or status from USG. Need more be said?

For obvious professional reasons, this structure precludes any genuinely adversarial peer review. Guild solidarity wins. Research empires may play at war, but it’s always easy for both sides to agree that both approaches deserve funding. This is mock battle, like the clash of rutting stags. Nature green in tooth and claw. (Unless there’s an actual interloper trying to horn in on the stream—in which case you’ll see the real claws.)

So as soon as you arrive at grad school, you’ll discover that no mileage whatsoever is to be attained by actually attacking the half-baked ideas of your peers. Proper career strategy is to build coalitions—not tear them down. Actual, rigorous, adversarial science still exists in a few nooks and crannies. The tradition is remembered. But it is by far the exception.

The pleasant flip side of this coin is that there is no punishment whatsoever for consorting with stupidity. After a while the successful academic learns to squelch the slightest hint of a giggle when confronted, on a daily basis, with loaves that have clearly never seen the inside of an oven. At least, he thinks, they’ve been kneaded. The grove is certainly not short of flour or water.

The brazen irony of this situation is that these institutions acquired their reputations over the course of many generations during which they exhibited no tolerance whatsoever for stupidity. What remains is not reputation—but merely position. Bite the ugly bone of it, bitches.

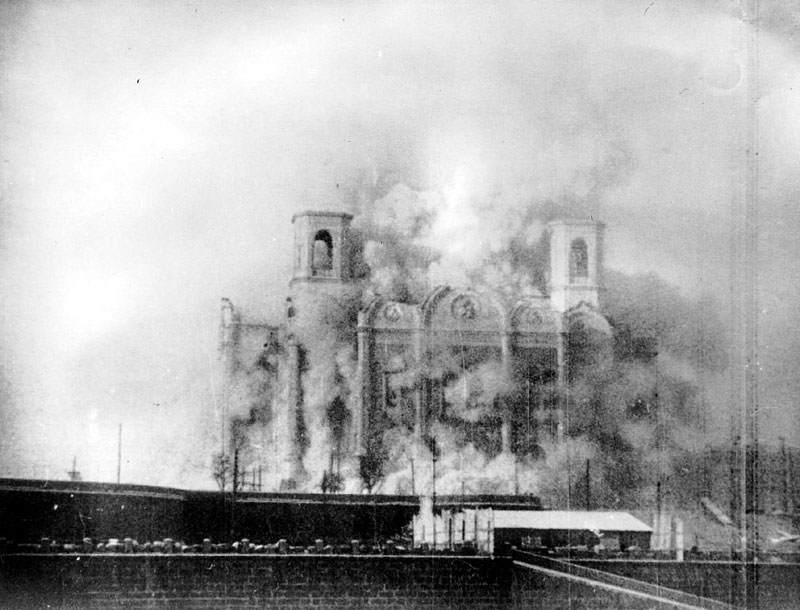

Here at UR, our program is clear: the only cure is the bulldozer. The universities must be razed to the foundation and below - converted into large, open-air swimming-pools, perhaps, like the Cathedral of Christ the Saviour. Indict the administrators (you can always find something), seize the trademarks, forfeit the endowments. The secret code word is: Pombal.

Since I am neither Stalin nor Pombal, I must resort to mere invective. Today I thought I’d work out on Professor Hanson, who perhaps of all those in his so-called field deserves it least. At least he has ideas, and bakes them—somewhat. But so what? The Chinese say: kill the chicken to scare the monkey. To scare a whole barn full of chickens, however, kill the monkey.

You can read Professor Hanson’s paper on his brilliant idea, futarchy, here. This other fellow—in professorland, it’s never too late to imitate—has attached his own even more tortured coinage to the same idea. Although Professor Abramowicz has quite sensibly toned his sales points down a few notches, and his reasoning is clearer and more precise as befits a law professor, he still does not appear to understand the basic ridiculousness of a “decision market.”

Basically, the summary is this: prediction markets are a fine idea, whereas decision markets are… well… retarded.

I was going to use Dijkstra’s wonderful coinage, considered harmful, but on reflecting I feel that decision markets are too retarded to qualify as harmful. Communism is harmful. Maturity transformation is harmful. Futarchy is retarded.

(This puerile slur has a special sweetness to me because, at the time I was in elementary school, it was just shifting from medical term to juvenile expletive—much like spastic. Obviously, the word is chosen to offend Professor Hanson, not those with actual neurological disabilities.)

Note first that empirical evidence confirms my prediction. I.e.: in the actual, real world, decision markets had a glorious and fatal collision with reality. While normally no fan of the demotic style in government, I must admit that on this occasion it worked perfectly as designed. Three cheers for popular common sense.

So far, this catastrophe seems to have done the job. The private sector will not adopt decision markets because they are obviously retarded. The public sector will not adopt decision markets because they got Admiral Poindexter fired. Sounds like multiple organ failure to me.

But inside the Beltway, bad ideas don’t stay dead. If it is obvious to you that decision markets are retarded, feel free to read no further. It’s not obvious to me that it’s obvious to everyone.

Briefly: almost every conceivable application of a decision market is, when conceived as a prediction market, a misdesigned prediction market. A misdesigned prediction market is one that does not produce accurate predictions. Obviously, inaccurate predictions produce bad decisions, making the whole exercise… well… retarded.

One trivial example of a liquid, functioning prediction market that does not, and cannot, produce accurate predictions is the gold futures market. The gold futures market is a large, active and efficient market in future gold, but in hindsight it demonstrates little or no predictive power. The cause is not at all obscure: since both gold and dollars can be stored at minimal cost, a variety of arbitrage strategies bind the gold futures market to the much larger dollar-futures market (i.e., the market for loans). The price signal is real, but it is conveying much more subtle data than the market’s net opinion of whether gold will go up or down.

At the neurological level, I think the problem here is that our professors don’t really understand why markets work. Obviously they are not alone in this. While I hate to sound like a leftist, even a stopped clock is right twice a day, and “market fundamentalism” is a genuine problem. Markets are wonderful devices, but they are not black boxes. They operate as a matter of engineering, not sympathetic magic. To examine them inductively is to not examine them.

To understand why (almost all) decision markets can’t work, we need to understand why (many) prediction markets do work. Here at UR, we like to work through things from scratch. Once we understand prediction markets and their limitations, the conclusion will conclude itself.

Of course, we can’t understand prediction markets until we understand markets. A market in any two fungible goods, A and B, is any device for discovering the A/B ratio P which equalizes D, the number of people who want to trade P units of A for one unit of B, with S, the number of people who want to trade one unit of B for P units of A.

In general we simplify this description by standardizing A as the currency—remembering that money, even paper money, is not an abstraction of value but just another good. P is price, S is supply, D is demand. Since more is always more than less, supply curves slope up and demand curves slope down.

The first thing to remember about your market is that there is no just price. Supply and demand are constantly fluctuating, and so must price. The market does not know why buyers buy or sellers sell. It records only the price signal.

The second thing to remember about your market is that supply and demand are measured only at the current price. Across any time period, we can see what the supply of B is for that time period, and for the price curve within it, just by counting the transactions. We can only guess what sales might have been at other prices.

Fine. Unless you are a professor, this is all you need to know about microeconomics. Let’s move on to prediction markets.

To create a prediction market, first: amass a large quantity of currency. For no good reason at all, let’s denominate our prediction market in gold. Each prediction note will redeem in gold. To create a prediction market, you issue prediction notes. To give these pieces of toilet paper value, you need to back them with gold. (Or more daringly, with a gold loan maturing on or before the first date at which the prediction test can be completed.)

For each gram of gold in your private Fort Knox, issue multiple prediction notes which pay out one gram of gold, if and only if a certain condition occurs. As along as the conditions on all the notes you match to each gram are mutually exclusive, and the underlying gram is secure, there is zero counterparty risk in your prediction market.

For instance, if the Lakers are playing the Nuggets, for each gram you could print up two notes, one which pays a gram if the Lakers win, one which pays a gram if the Nuggets win, and sell them on EBay. For a horse race with nine horses, etc. This would be perfectly sound from an accounting perspective, if it wasn’t illegal. Trivial, knowledge-independent arbitrage will ensure that the prices (in gold) of all notes backed by each gram sum precisely to that gram.

So far, this sounds like a simple gambling system, which is exactly what it is. What could possibly give this little bookie trick its weird, sibylline power of telling the future?

The assumption, which will be correct in many cases, is that the relative prices of Lakers and Nuggets notes, on Ebay, will indicate the relative probability of a Lake rs or Nuggets victory. If you go here, you can see Professor Abramowicz eloquently assuming this conclusion.

Which is certainly correct in many cases. To understand why futarchy is retarded, however, we’ll have to look at this result much more closely.

First, what the heck do we mean by probability? Suppose, on Ebay, you can buy a Lakers gram for 650mg and a Nuggets gram for 350mg. In reality, the Lakers will win and the Nuggets will lose, or vice versa. According to the frequentist interpretation, it makes no sense at all to talk about probability in this context, because we are predicting a one-time event.

The answer indeed demands a frequentist sample space. If we describe the market for NBA prediction notes as that sample space, we can say: for the set of all NBA games, does the market’s prediction tend to match the actual results? Or can we identify any regular patterns of error in the market? For example, if the Lakers-Nuggets odds are 65–35, yet some pattern of which this game is a member predicts 50–50 results, there may be an error. Any event, of course, may be a member of all sorts of sample spaces.

We see instantly that, even in just attempting to discern whether a prediction market is accurate, we face a difficult struggle. Yet our good professors assume their design will work out of the box.

Moreover, we see something even more revealing. By using the example of professional sports, where we know that outcomes are extremely difficult to predict, we realize what we should have known all along: markets are not magic. They aggregate. They don’t create. If the Ebay NBA prediction-note market can set good odds for the Lakers-Nuggets game, it does not pull this information out of the Akashic Ether. Somewhere out there on the Internet, there must be someone who actually knows something about hoops. And he must have money on the game.

Prediction markets cannot defeat the iron law of HR: morons in, garbage out. For a market to produce accurate predictions, there must be genuine experts in the market, and they must be substantially better-funded than the morons. A prediction market funded entirely by dumb money, played entirely by dumb players, will produce entirely dumb predictions.

For example: suppose you sell prediction notes not for a basketball game between the Lakers and the Nuggets, but for a planetary gormball game between the Ganymede Ellipses and the Neptune Lumbos? Is there anyone or anything who (a) knows anything whatsoever about the Ellipses, the Lumbos, or planetary gormball, and (b) has an EBay account? I thought not. Therefore, your market will have zero predictive power. The information just isn’t there.

This is Feynman’s problem of the Emperor of China’s nose. If no one has ever seen the Emperor of China’s nose, can a prediction market predict its length? Mind you, the professors will not tell you that their devices can compute unknown information, such as the length of the Emperor of China’s nose. But they hardly spend much time warning us that they can’t.

Worse, if you do make a market in the Emperor of China’s nose, the prediction notes will trade. They will trade randomly. The worst case is that in which nobody has any way of actually calculating the prediction, but no one in the market is sure that this is the case. Your market signal will look exactly like that of an accurate prediction market, but predict nothing at all.

In this worst case, there is a real signal. You just can’t tell whether your antenna is receiving the signal, or generating its own noise. The perfect basis for decision-making! Why don’t you just go ahead and solder that wire straight to the detonator, Professor Teller. (But I skip ahead.)

So this is our first precondition for an accurate prediction market: there has to be some practical algorithm by which market participants can compute the prediction. No smart players, no smart money, no smart market. Sorry.

Our second precondition, which again though obvious is not obviously obvious to everyone, is that an accurate prediction market must be dominated by its accurate predictors. I.e.: the smart money must be the big money. Otherwise, the voice of the market is the voice of stupid.

NBA odds are accurate not just because good NBA predictors are in the basketball prediction market, but because the biggest money is behind the best predictors. The same is true of financial markets—under most normal conditions. (As I write, GM stock, worthless by all conventional measures of valuation, is trading for a buck-fifty.)

This condition of broad, general efficiency is almost always found in large, old, and heavily-traded markets. It is not easy to beat Vegas, or Wall Street. It is a mistake to assume, however, that general efficiency is an automatic property of the market design, or even of the amount of money that is put into it. It is certainly a mistake to believe that an efficient market can be created in some professor’s DARPA-funded experiment, using fifty undergraduates playing for six months with Monopoly money.

Any efficient market is a Darwinian, adaptive, phenomenon. Good predictors dominate because, and only because, good predictors tend to win and keep playing, bad predictors tend to lose and quir. Professor Hanson alludes vaguely to this phenomenon when he writes:

And the rich do not tend to throw their money away easily; those who do, do not stay rich very long.

Indeed. But Professor Keynes once alluded to the limitations of this approach:

The markets can stay irrational longer than you can stay liquid.

In an old and healthy prediction market we would indeed expect to see accurate predictions. But only in the case in which Darwinian forces have been operating for a substantial period of time, selecting in favor of the good predictors and against the bad. And, of course, there has to be a good prediction algorithm and people who can apply it. Otherwise—irrational markets exist.

A market, to exhibit efficiency, must be trained. It is necessary, but not sufficient, to have an actual signal and an actual algorithm for predicting that signal. Then you need a population of “speculators,” as Hanson so charmingly puts it. (As a student of modern European history, I’m afraid that whenever I hear this word, my brain cannot help appending “and Jews”—an edit which converts certain White House emissions into perfect material for the Völkischer Beobachter or Radio Rome.) Over time, due to said Darwinian forces, the observer can expect the smart speculators and Jews to flourish and multiply, and the stupid speculators and Jews to dwindle and drop out. Which should produce an efficient market. Eventually.

Basically, the mathematical construct Professor Hanson and his ilk call a “market” is a market in which this training process has already happened. With this assumption, they permit themselves to ignore the problem of actually building their prediction market. Overnight and without effort, their pinecone turns into an old-growth redwood.

Analogy: humans evolved from chimps, or something like chimps. However, this does not mean that if you send a chimp to Harvard for an MBA, in two years he will evolve into a human and be ready to work at a hedge fund. Similarly, if you recruit a hundred chimps and two professors to participate in a prediction market, the initial prices they produce will be chimp prices.

It’s true that over time, the chimps will prosper and the professors will go bankr—sorry! I mean, of course, that the professors will prosper and the chimps will go bankrupt. But to merely assume the outcome of this process, as a detail of the model, is negligent at best and downright deceptive at worst. Especially when you’re trying to instantiate a new market!

In particular, the adaptive explanation of market efficiency tells us why prediction markets with pretend money are a complete waste of time. These just aggregate the whims of the participants. There is no evolution at all. In other words: we are back at the democratic fallacy, vox populi vox dei. You might as well just hold an election.

Worse, the training process that produces an effective prediction market is not only long, difficult, and expensive—it is fragile. It is easy to mistrain a prediction market. Example: any market which contains multiple equilibria—such as a loan market based on maturity transformation (e.g., fractional-reserve banking).

If the market has multiple states which it can switch between, a market which is perfectly trained for the “good times” state may well be perfectly mistrained for the “bad times” state. Gaia herself has seen a lot of this tsuris in the Holocene, with its constant bipolar wobbling between ice ages and interglacials. Not good for the sabertoothed tigers. And financial examples of mistraining are not exactly hard to find these days.

A third precondition is that the prediction market is not arbitrage-bound to some other market, which may not be efficient. Again, the market for future gold does not function as a prediction market, because it is bound by arbitrage to the market for spot gold and the market for future dollars. At least one of these so-called markets is substantially the product of official intervention. This effect is not relevant to most decision markets, so I’ll ignore it for now.

It’s our fourth precondition that starts to get interesting. A prediction market only makes valid predictions if it can resist feedback, where feedback is any effect of the market’s result on the interests of the players. Until now, we have been assuming that the price signal produced by the market has no external consequences. But obviously, if we are using it to make decisions, this cannot be true.

The trivial example of a prediction market with a fatal feedback disorder is a market which predicts its own result. For example, the gram of gold underwrites two notes, A and B, such that the gram will be issued to whichever of A and B trades at a higher price on such and such a day. This is obviously a completely deranged market—a tape-painting contest.

Feedback creates a problem which is quite different from the ordinary market-manipulation problem. Without feedback, there is no systematic way to profit by manipulating a market. You can buy up any security to drive the price higher, but your only avenue for profit is selling. This is the “burying the corpse” problem.

But with feedback, players with a financial interest in the effect of the prediction have an interest which conflicts with the efficiency of the market. Depending on the prediction’s effect, their profit may be arbitrary—policy control can be quite profitable. And it can be extracted without burying the corpse.

The loss? Well, it depends. See how Professor Hanson addresses this objection:

If prices determined policy, and if trades move prices, then could someone buy a favorable policy just by making the right trades? No; a new trade typically moves prices because other traders suspect that this new trader has new information. When other traders with deep pockets can clearly observe that a particular person is trading for non-information reasons, such traders will not allow the price to change.

This apologia contains three serious fallacies.

First, a new trade does not move prices because it is observed. It may have such an indirect effect, but it starts with a direct effect. A new trade moves prices because it represents new demand (or supply), and prices are set by supply and demand. For this direct effect to be countered, the speculators and Jews must actually trade against the new buyer.

Second, the implied assumption that our speculators and Jews can observe the order flow, and know who is trading and why, is completely contrary to both the theory and practice of financial markets. The whole point of a market is that it produces one information stream: a price signal.

Third, and most important, note the “other traders with deep pockets”—these are our trained speculators and Jews. What Professor Hanson is saying is that because the market is dominated by smart money, interested feedback players will not be able to move the market. Of course, this assumes a market dominated by smart money.

Professor Hanson is perfectly correct in his analysis of his own model. In this model, in which market efficiency is enforced by speculators and Jews who are both omniscient and infinitely funded, any attempt to move the market for feedback purposes—or any other purpose—will either (a) fail, or (b) lose an infinite amount of money. Thus, the potential profits of feedback are irrelevant. However profitable steering the prediction may be, this profit must be finite, so it will not exceed the losses from the scheme—which are infinite. QED.

I trust the discerning UR reader has seen this sort of spherical cow before. The crucial point in this case is that for Professor Hanson’s theory to work, the cow must not just be roughly round, but a perfect Platonic sphere. Otherwise, the losses at the hands of the remorseless speculators and Jews need not be infinite—and the feedback scheme may well net a profit. Oops.

And fifth—oh, fifth. A prediction market, like any other market, functions only in the general absence of asymmetrical information. It is with some pain that I absorb the realization that a member of the George Mason School is unable to correctly apply this concept.

In plain English, the rational approach to a market in which other players have more information than you is not to play. If insiders who have material non-public information are trading, the rational player without it will avoid the market. “This mechanism is repeated until a no-trade equilibrium is reached.”

I mean, duh. This is one of the many reasons why insider trading is illegal (a prohibition I am not sure Professor Hanson agrees with). In my libertarian utopia, insider-trading enforcement would invoke sufficient deterrent penalties through the employment contract—insider trading is breach of contract, not a crime against the State, but you should be free to sign a contract that decapitates you if you’re caught at it. But whatever. If insiders were free to trade stocks, no one but insiders would trade. Did we need Professor Akerlof to tell us this?

Consider how this applies to Admiral Poindexter’s brilliant baby, the terrorism prediction market. Who has asymmetric information about future terrorist attacks? Um…

To preempt this concern, Professor Hanson can only note that in theory this attack could be performed with anti-corporate terrorism and short-selling of stocks, and it hasn’t:

Suspicions about the Tylenol poisoning case and the World Trade Center attacks were never substantiated.

All I can say is that I prefer my security to operate on principles which are deductive, not inductive. There’s a first time for everything.

There also isn’t a lot of anti-corporate terrorism. Sovereigns, to whom Professor Hanson is recommending his market design, differ from corporations in two ways: they leak a lot more internal information. And they have a lot more enemies.

So we’ve seen the five preconditions required for an accurate prediction market. Now, in case it isn’t already obvious why futarchy is… retarded, let’s summarize.

First: because its uncanny accuracy is not a product of magic, but of adaptive evolution, an accurate prediction market cannot simply be instantiated. It must be trained. During the training period, it is an inaccurate prediction market.

This is fatal to the entire design. Obviously, a decision market driven by inaccurate predictions is a deranged form of government. An accurate market cannot be created overnight. But who wants to run an inaccurate futarchy for a training period? Again: retarded.

Second: while one can imagine schemes for training market players on a scratch monkey, any deployment of a decision market would be irresponsible without some way of testing whether the market is predicting accurately, and thus producing sane decisions rather than insane ones. But as we saw earlier, testing the accuracy of a prediction market—i.e., distinguishing between a real market and a noise market, an Emperor-of-China’s-nose market—is close to impossible.

Consider Professor Abramowicz’s objection to Professor Hanson’s more aggressive sales pitch. This criticism, while accurate, is so understated as to be comical:

As discussed in Chapter 7, conditional prediction markets may each have enough noise that comparison of the market prices is meaningless. This may be an even greater problem than Hanson allows, because probably only a relatively small percentage of policy proposals would be big enough to have a significant impact on GDP+. Suppose, for example, that the level of precision of each conditional prediction market would be within 0.1 percent. That would mean an error of approximately eleven billion dollars based on current values, so proposals whose impact would be in the millions or low billions of dollars could not be clearly evaluated.

To be fair to Professor Abramowicz, I suspect that this paragraph was written before 2008. But suffice it to say that if you have a formula for predicting GDP “within 0.1 percent,” you don’t need to worry about money.

Of course, in order to make an accurate bet that some policy or other will increase GDP, as opposed to no policy at all, you first need an accurate estimate of GDP assuming no policy change at all. Whose error bars are shorter than the impact you expect from the policy change.

In other words, Professor Hanson is basically expecting the AM antenna on his ghetto blaster to pick up signals from Alpha Centauri. Do our professors know anything about financial markets? Eg: have they ever traded a stock? Again: retarded. Give me Macro Man any day.

And third: if the prediction market is not functioning efficiently, the decision market becomes exactly what its name suggests, and what it is designed not to be: a market on which decisions are purchased. The defense against decision purchases assumes a perfectly efficient market.

Since there is no test for efficiency, and since the market has no reason to exhibit this efficiency until it has been trained, in real life every decision market is likely to consist of noise and feedback until some critical mass of speculators and Jews works out a prediction algorithm. We cannot know when this happens—even after it happens. Once more: retarded.

And fourth, there is one other small point which deserves mention. Obviously, futarchy cannot condition a prediction note on the difference between two mutually exclusive policies A and B, since only one of A and B can be enacted. Instead, it must issue two classes of prediction note, each conditional on a decision: A is better than nothing, versus A is not better than nothing; B is better than nothing, versus B is not better than nothing. “A is better than B” cannot be computed—even with a perfectly efficient market.

As we’ve seen, the comparison to nothing is clunky and implausible, because it depends first and foremost on a very accurate prediction of the null policy. But let that be. These conditional notes have a second problem. What happens to the B notes, if policy A is enacted?

Professor Hanson’s answer is that all transactions in them are rolled back. Indeed, this is the only conceivable solution. For example, if when A is chosen, we simply close out the B notes at their current price, we get a perfect feedback market. It is worth noting, however, that while systematically reverting all transactions in a given security is theoretically possible—it is anything but a normal feature of financial markets. Professor Hanson does not mention this. Frankly, he should.

As a detailed explanation of why futarchy is… retarded, I feel this should suffice. But we started out with a much larger point. We need to get back to it.

Clearly, Professor Hanson does not suffer from actual neurological deficits. So what leads this loyal, imaginative, and relatively sensible servant of USG to invest so much effort in an idea so blatantly fscked in the head? The answer leads us to more tasty delusions.

In this big-picture analysis, our new question is: why? Why would anyone even consider the possibility of considering so… retarded an idea as futarchy?

Our first clue to the answer is provided by the marketing orientation of both Professors, Hanson and Abramowicz. Their primary angle seems to be in recommending decision markets to USG. This may not seem odd, but it is.

After all, those who know USG know that daring procedural innovation is not exactly its strength. If futarchy or predictocracy is truly an effective new way to make decisions, don’t you think our good professors would have better luck in marketing it to, say, Apple? I mean, why doesn’t Apple use decision markets already? They seem so, well, wired.

Well. I have never worked for Apple, but I have worked for some of its competitors. And I can tell you exactly how decisions get made at Apple. Or at its competitors.

You see, Professors, when Apple wants to make an important decision, here’s how Apple does it. First—not being un-PC, just quoting Mark Twain—Apple finds a man. Hires him, in fact. And having hired this man, it tells him: sir, this decision is yours.

Consult with your subordinates, consult with your supervisor, consult with your colleagues, consult with El Stevo himself. Do you need data? Immerse yourself, sir, in data. Is technical input required? Apple’s star nerds shall file, one by one, into your cube. But at the end of the day, you are a man, this decision is yours, and you are responsible for its consequences.

No process is more foreign or repugnant to USG. Granted, a decision or two makes its way up, in carefully premasticated form, to the Oval Office. Even then, the masticators tend to be pretty certain of what the result will be, if not which masticator it will favor. The One, though a Lightworker, is human—what he knows is what he is told. And more important, his decisions are entirely reactive—he can’t wake up in the morning and decide to close the Department of Commerce. The system treats him as an oracle. In fact, rather as if he was a decision market. Power is in the hands of those who formulate the questions.

But for its normal business, 99.9% of which never gets near the White House, USG abhors personal decisions and personal responsibility pretty much the way the Devil abhors garlic. Even the idea of a decision is slightly repugnant to the mindset of governance—it sounds almost dictatorial. Hitler made decisions—he could do the wrong thing, or the right thing. USG has no such vulnerability to personal whim. It always does the right thing.

The question is how that right thing is defined. Within USG, here are the preferred sources of policy, ranked in order of rough precedence.

#1: the law. A USG employee is always on extremely solid ground when his actions are dictated by the majesty of the law. He has no choice at all. Therefore, he cannot possibly be accused of any personal turpitude, and nor is he responsible for any suboptimal outcome. Fiat justitia, ruat coelum. Sorry, bub, it’s the law. He just works here. Of course, anything good that happens in his vicinity will redound to his credit. With the law—you can’t lose.

#2: science. The ordering of #1 and #2 are a matter of taste, as the two hardly ever conflict these days. Indeed, when science is available, if you read the law it will generally say: follow science. And #2 enjoys all the fine benefits previously described under #1.

#3: public opinion. USG is, of course, a democracy. Sometimes it is helpful, in future-proofing one’s ass-covering, to know not just what public opinion is today, but what it will be tomorrow. Ask a journalist—that’s his job. Of course, when today’s public opinion conflicts with science or the law, it is the role of the brave civil servant to defy it. And of the journalist to mend it.

#4: a committee. Sadly, some decisions appear for which #1, #2 and #3 produce no clear answer at all. In this case, the only remedy is to gather as many “stakeholders” as possible in the same room. After all, too few cooks spoil the broth, they say.

#5: personal authority. This is sometimes sufficient to order pens. But usually not.

The pattern here is not hard to find. USG craves mechanical processes for decision-making. If a decision is made mechanically, no one is responsible for any bad results. Since mechanical management tends to produce bad results, this ass-covering imperative perpetuates itself. Of course, everyone in USG wants to be “in the loop” on everything—even the disasters. Better to be in on a fiasco than twiddling your thumbs around a success. Who needs responsibility?

And mechanical decision models have another benefit. Obviously, USG makes real decisions all the time. Somewhere inside the great machine, there are real people with real power. But, since they exert that power by massaging a mechanical decision process—by disguising their personal whims, which are just as personal as anyone’s, in the trackless bureaucratic wastes of law or science or the like—they get to rule in secret. Power without responsibility. What fun!

Mechanical decision processes perform a kind of power laundering. Because all these processes can be gamed and hacked and massaged, they are not truly mechanical at all. But since the machine is so complex as to be incomprehensible to outsiders, no one can see the true power structures of the Beltway.

Thus the incentive for futarchy. If it wasn’t retarded (and indeed, it is no more retarded than many of the phenomena that inside the Beltway pass for law or science), it would fit perfectly in this hierarchy, right between #2 and #3. Law, or science, or the market. Of course, if science tells us to ask the market—then there’s no conflict, then, is there? And so it goes.

You might think this is a new problem. Au contraire. It is intrinsic to 20th-century economics, which stole the good name of 19th-century political economy and applied it to the science of economic central planning. Like any zombie, the whole field cries out for its nine grams of lead. And its cold, stinking life in death is older than most can imagine.

Consider Professor Hanson’s favorite statistic—GDP. If we translate GDP into Apple terms, it is gross revenue. GDP is simply the total sales of all American companies.

So suppose our man, at Apple, had access to a perfect Hansonian decision market, which for any policy could calculate whether or not that policy would increase Apple’s sales. Forget all the problems—assume the design just works. Would he find this tool useful?

Somewhat, I’m sure. But only somewhat. Many bad decisions increase gross revenue. What about costs? What about quality? What about customer service and brand reputation? What about employee morale? Etc., etc., etc. Your man must balance all these factors. Whereas his decision machine, magic as it is, sees only one.

Snap back to the sovereign sphere—and back 150 years. Let’s go to that great critic of economics: Carlyle. Mr. Dismal Science. I’m ashamed to admit that when I first read Carlyle, I was still under the spell of Mill, Cobden and Bright, the “classical liberals.” I did not see the tremendous power and prescience of Carlyle’s economic critiques.

Such as this one:

A witty statesman said, you might prove anything by figures. We have looked into various statistic works, Statistic-Society Reports, Poor-Law Reports, Reports and Pamphlets not a few, with a sedulous eye to this question of the Working Classes and their general condition in England; we grieve to say, with as good as no result whatever. Assertion swallows assertion; according to the old Proverb, ‘as the statist thinks, the bell clinks’! Tables are like cobwebs, like the sieve of the Danaides; beautifully reticulated, orderly to look upon, but which will hold no conclusion. Tables are abstractions, and the object a most concrete one, so difficult to read the essence of. There are innumerable circumstances; and one circumstance left out may be the vital one on which all turned. Statistics is a science which ought to be honourable, the basis of many most important sciences; but it is not to be carried on by steam, this science, any more than others are; a wise head is requisite for carrying it on. Conclusive facts are inseparable from inconclusive except by a head that already understands and knows. Vain to send the purblind and blind to the shore of a Pactolus never so golden: these find only gravel; the seer and finder alone picks up gold grains there. And now the purblind offering you, with asseveration and protrusive importunity, his basket of gravel as gold, what steps are to be taken with him? —Statistics, one may hope, will improve gradually, and become good for something. Meanwhile, it is to be feared the crabbed satirist was partly right, as things go: ‘A judicious man,’ says he, ‘looks at Statistics, not to get knowledge, but to save himself from having ignorance foisted on him.’ With what serene conclusiveness a member of some Useful-Knowledge Society stops your mouth with a figure of arithmetic! To him it seems he has there extracted the elixir of the matter, on which now nothing more can be said. It is needful that you look into his said extracted elixir; and ascertain, alas, too probably, not without a sigh, that it is wash and vapidity, good only for the gutters.

Twice or three times have we heard the lamentations and prophecies of a humane Jeremiah, mourner for the poor, cut short by a statistic fact of the most decisive nature: How can the condition of the poor be other than good, be other than better; has not the average duration of life in England, and therefore among the most numerous class in England, been proved to have increased? Our Jeremiah had to admit that, if so, it was an astounding fact; whereby all that ever he, for his part, had observed on other sides of the matter, was overset without remedy. If life last longer, life must be less worn upon, by outward suffering, by inward discontent, by hardship of any kind; the general condition of the poor must be bettering instead of worsening. So was our Jeremiah cut short. And now for the ‘proof’? Readers who are curious in statistic proofs may see it drawn out with all solemnity, in a Pamphlet ‘published by Charles Knight and Company,’—and perhaps himself draw inferences from it. Northampton Tables, compiled by Dr. Price ‘ from registers of the Parish of All Saints from 1735 to 1780’; Carlisle Tables, collected by Dr. Heysham from observation of Carlisle City for eight years, ‘ the calculations founded on them’ conducted by another Doctor; incredible ‘document considered satisfactory by men of science in France’:—alas, is it not as if some zealous scientific son of Adam had proved the deepening of the Ocean, by survey, accurate or cursory, of two mud-plashes on the coast of the Isle of Dogs? ‘Not to get knowledge, but to save yourself from having ignorance foisted on you!’

Two mud-plashes on the Isle of Dogs! See under: Climate Audit. Carlyle continues:

What constitutes the well-being of a man? Many things; of which the wages he gets, and the bread he buys with them, are but one preliminary item. Grant, however, that the wages were the whole; that once knowing the wages and the price of bread, we know all; then what are the wages? Statistic Inquiry, in its present unguided condition, cannot tell. The average rate of day’s wages is not correctly ascertained for any portion of this country; not only not for half-centuries, it is not even ascertained anywhere for decades or years: far from instituting comparisons with the past, the present itself is unknown to us. And then, given the average of wages, what is the constancy of employment; what is the difficulty of finding employment; the fluctuation from season to season, from year to year? Is it constant, calculable wages; or fluctuating, incalculable, more or less of the nature of gambling? This secondary circumstance, of quality in wages, is perhaps even more important than the primary one of quantity. Farther we ask, Can the labourer, by thrift and industry, hope to rise to mastership; or is such hope cut off from him? How is he related to his employer; by bonds of friendliness and mutual help; or by hostility, opposition, and chains of mutual necessity alone? In a word, what degree of contentment can a human creature be supposed to enjoy in that position? With hunger preying on him, his contentment is likely to be small! But even with abundance, his discontent, his real misery may be great. The labourer’s feelings, his notion of being justly dealt with or unjustly ; his wholesome composure, frugality, prosperity in the one case, his acrid unrest, recklessness, gin-drinking, and gradual ruin in the other,—how shall figures of arithmetic represent all this? So much is still to be ascertained; much of it by no means easy to ascertain! Till, among the ‘Hill Cooly’ and ‘Dog-cart’ questions, there arise in Parliament and extensively out of it ‘a Condition-of-England question,’ and quite a new set of inquirers and methods, little of it is likely to be ascertained.

Alas, the inquirers and methods of Carlyle’s day would strike any servant of USG as wildly, fantastically phronetic. In the 1840s, this rotting ulcer, this pizza-sized melanoma, the great fraud of the mechanical decision process, was just a little pimple. Carlyle saw it, and diagnosed it. You’ll find little here at UR which isn’t in the Latter-Day Pamphlets. And the condition of England? In 2009?

Unspeakable. Or dare I say… retarded. No—there is only one conceivable solution: